SM Entertainment Stock: A Comprehensive Analysis of Growth, Challenges, and Investment Potential

SM Entertainment Stock founded in 1995 by Lee Soo-man, has established itself as a cornerstone of South Korea’s entertainment industry. Often referred to as the “Big 3” agency alongside HYBE and YG Entertainment, SM Entertainment is synonymous with innovation, cultural influence, and the global rise of K-pop. The company’s stock (KRX: 041510) has garnered significant attention from investors, driven by its dominance in music production, artist management, and multimedia ventures.

The agency’s success is rooted in its systematic approach to talent development. SM’s “cultural technology” model—a blend of rigorous training, strategic branding, and cross-media storytelling—has produced iconic acts like H.O.T., BoA, TVXQ!, Girls’ Generation, EXO, and NCT. These artists not only dominate domestic charts but also command massive international followings, contributing to SM’s revenue through album sales, concerts, merchandise, and licensing deals.

Beyond music, SM Entertainment has diversified into film production, gaming, and tech ventures. Its subsidiary, SM Studios, focuses on creating K-dramas and films, while partnerships with companies like Kakao and阿里巴巴 (Alibaba) have expanded its digital footprint in streaming and e-commerce. This multifaceted business model positions SM as more than just a music label—it’s a global entertainment conglomerate.

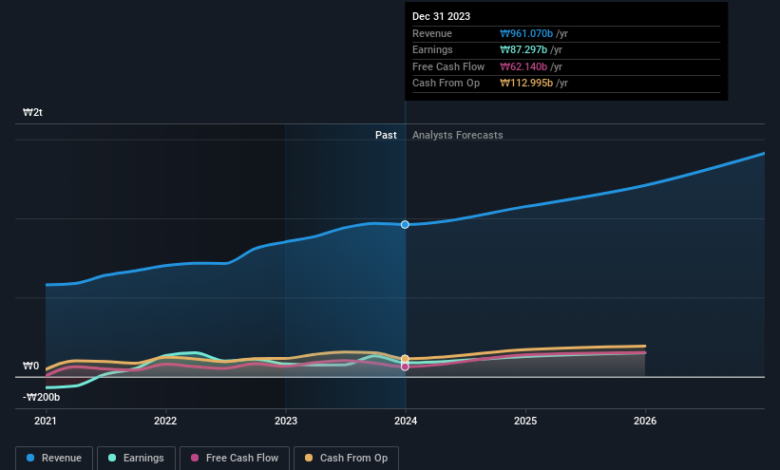

Financial Performance: Breaking Down SM Entertainment’s Market Position

SM Entertainment stock financial health reflects its industry leadership. Over the past decade, the company has reported steady revenue growth, driven by album sales, concert tours, and digital content. In 2022, SM recorded annual revenues of approximately KRW 700 billion (around $540 million), a 15% increase from the previous year. Net profits surged by 20%, fueled by successful comebacks from aespa, NCT Dream, and Red Velvet.

A key revenue driver is SM’s global expansion strategy. The agency has capitalized on the Hallyu Wave (Korean Wave), targeting markets in North America, Europe, and Southeast Asia. For instance, NCT’s global unit, NCT Hollywood, and aespa’s Metaverse-focused concept highlight SM’s push to blend K-pop with Western entertainment trends. Additionally, SM’s collaboration with platforms like YouTube and Spotify ensures its artists dominate global streaming charts, translating to higher royalty income.

However, SM faces challenges typical of the entertainment sector. High production costs, reliance on a few top-tier artists, and the volatility of public taste create financial risks. For example, the COVID-19 pandemic severely impacted live event revenues, which historically accounted for 30% of SM’s income. Despite this, SM’s pivot to virtual concerts and NFT-based merchandise showcased its adaptability—a trait that reassures investors during uncertain times.

Competitive Landscape: How SM Stacks Up Against HYBE and YG

The K-pop industry is fiercely competitive, with HYBE (home to BTS) and YG Entertainment (Blackpink’s agency) vying for market share. SM’s stock performance often hinges on its ability to stay ahead of these rivals. While HYBE’s market capitalization dwarfs SM’s due to BTS’s global superstardom, SM maintains an edge in artist diversity and creative experimentation.

SM’s multi-label system allows it to manage sub-units like SuperM (a “K-pop Avengers” group featuring members from EXO, SHINee, and NCT) and soloists like Taeyeon and Kai. This approach mitigates risks associated with over-reliance on a single act. In contrast, HYBE’s dependency on BTS has led to stock fluctuations amid the group’s hiatus announcements.

YG Entertainment, meanwhile, focuses on cultivating smaller, high-impact rosters. While Blackpink’s record-breaking tours boost YG’s revenues, SM’s consistent output of new groups (e.g., RIIZE, a 2023 debut) ensures a pipeline of fresh content. Investors often view SM’s ability to balance legacy acts with rookie groups as a stabilizing factor for long-term growth.

Risks and Challenges: What Could Derail SM’s Stock Momentum?

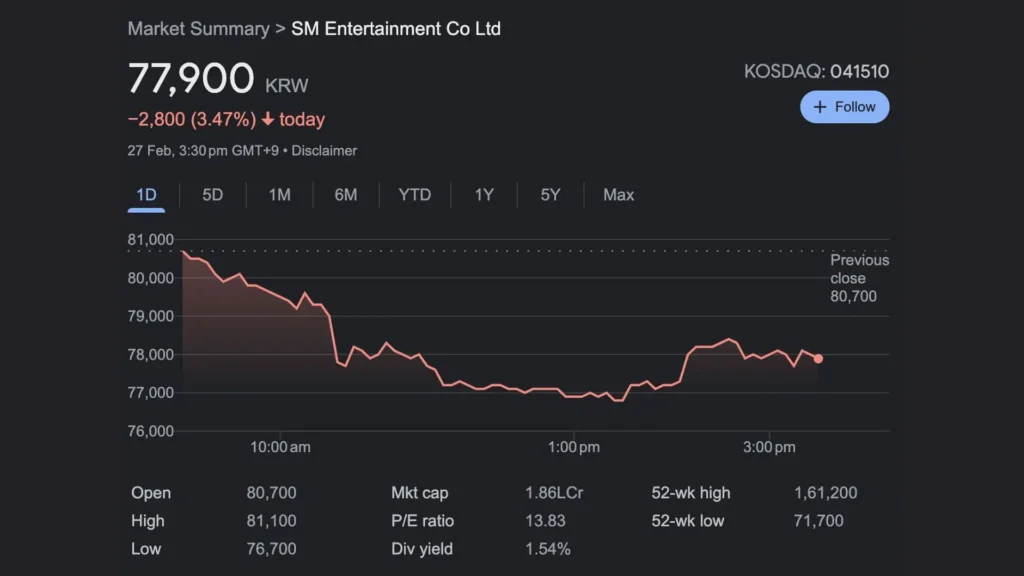

No investment is without risks, and SM Entertainment is no exception. One critical concern is internal management turmoil. In early 2023, a highly publicized feud between founder Lee Soo-man and Kakao (a major shareholder) over control of the company led to stock price volatility. While the dispute was resolved through a strategic partnership, it underscored governance risks that could spook investors.

Another challenge is the saturation of the K-pop market. With hundreds of debuts annually, sustaining public interest in SM’s groups requires immense marketing budgets and innovative concepts. For instance, aespa’s AI-driven “virtual avatar” concept initially faced skepticism but eventually paid off with viral success. However, not all experimental ventures succeed—SM must continually balance creativity with commercial viability.

Regulatory risks also loom. South Korea’s strict labor laws and scrutiny over trainee contracts could lead to legal disputes or reputational damage. Additionally, geopolitical tensions—such as China’s occasional restrictions on K-pop content—may limit SM’s access to lucrative markets.

Investment Potential: Why SM Entertainment Stock Remains Attractive

Despite challenges, SM Entertainment stock offers compelling opportunities. Analysts highlight three key factors: global growth prospects, digital innovation, and strategic partnerships.

- Global Expansion: SM’s push into Western markets is gaining traction. NCT 127’s U.S. tours sell out within minutes, while aespa’s collaborations with Warner Records signal deeper integration into the American music industry. The agency’s focus on multilingual content (e.g., songs in English, Spanish, and Mandarin) broadens its appeal.

- Digital and Metaverse Ventures: SM is a pioneer in leveraging technology. Its “SM Culture Universe” (SMCU) blends music videos, webtoons, and virtual reality experiences, creating immersive storytelling. The company’s NFTs, sold via platforms like Binance, have also opened new revenue streams.

- Partnerships with Tech Giants: Alliances with Kakao (for music distribution) and阿里巴巴 (for China-focused projects) enhance SM’s distribution networks. These collaborations reduce operational costs and amplify reach.

FAQs: SM Entertainment Stock

Q: What makes SM Entertainment stock a good investment?

A: SM’s diversified revenue streams, global fanbase, and innovative use of technology position it for long-term growth. Its ability to adapt to industry trends (e.g., Metaverse, NFTs) adds further upside potential.

Q: What are the main risks of investing in SM Entertainment?

A: Key risks include reliance on public taste, management disputes, and geopolitical factors affecting international markets.

Q: How does SM’s stock performance compare to HYBE’s?

A: HYBE’s stock is more volatile due to its reliance on BTS, while SM offers stability through a broader artist portfolio.

Q: Does SM Entertainment pay dividends?

A: SM has occasionally issued dividends, but reinvestment into growth initiatives often takes priority.

Q: How has K-pop’s global popularity impacted SM’s stock?

A: The Hallyu Wave has driven SM’s international revenues, boosting investor confidence and stock valuation.

Q: What role does Kakao play in SM’s business strategy?

A: Kakao provides distribution and tech support, enabling SM to streamline content delivery and monetize digital platforms.